Видео ютуба по тегу State Taxes

5 State RETIREMENT Tax Considerations You're Likely Not Considering... (State Taxes Explained)

State vs. Federal Taxes Explained in 2 Minutes! 🌎 Key Differences You Need to Know

The States with the HIGHEST and LOWEST Taxes. And where your money goes.

Calculating state taxes and take home pay | Taxes | Finance & Capital Markets | Khan Academy

6 Overlooked State Tax Considerations When Retiring

States with NO State Income Tax!!!! Tax Friendly States

Sprintax Returns | Step 6 | State Taxes

States With The Highest And Lowest And No Sales Tax Rates - States With Lowest Local Sales Tax

Lawmakers debating $60 billion state budget

Whay is Nexus for State Taxes? CPA Exam REG

$100,000 After Taxes in New York vs. Texas #newyork #nyc #texas #salary

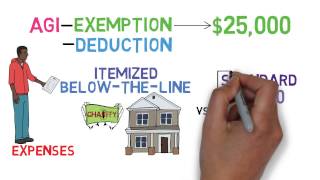

Tax Basics For Beginners (Taxes 101)

Taxes 101 (Tax Basics 1/3)

The Largest Tax Increase in History | Todd Myers

9 U.S. States with Zero Income Tax! 2024

Paying State Income Tax in the Military (or NOT paying)

The Ultimate Guide To Tennessee State Taxes

The 9 States with ZERO Income Tax

New York State Taxes Explained: Your Comprehensive Guide

Washington State Taxes Explained: Your Comprehensive Guide